Birch Gold Group stands out as a prominent player in the precious metals IRA market, catering to investors who want to diversify their retirement portfolios with gold and silver.

Birch Gold Group: A 2026 Investor Review

Birch Gold Group stands out as a prominent player in the precious metals IRA market, catering to investors who want to diversify their retirement portfolios with gold and silver. Founded in 2011 and headquartered in Des Moines, Iowa, this company has grown into one of the nation’s largest precious metals dealers. It primarily serves individuals looking to roll over existing retirement accounts like 401(k)s or IRAs into self-directed precious metals accounts, positioning itself as a "bridge" for the everyday investor.

As economic uncertainties linger in 2026, with inflation concerns and market volatility, many retirees and high-net-worth individuals turn to firms like this one for asset protection. But does it deliver on its promises? This review draws from multiple sources to assess its operations, strengths, and potential drawbacks.

Final Comparison and Verdict

Pros at a Glance

-

Accessibility: Low $10,000 minimum for IRAs and $5,000 for cash.

-

Service: Dedicated "Precious Metals Specialist" for every account.

-

Selection: Offers all four precious metals: Gold, Silver, Platinum, and Palladium.

-

Incentives: First-year fees waived for transfers over $50,000.

Cons at a Glance

- Spread Risk: Potential for high premiums on "premium" coins that aren't clearly itemized.

- Technology: Phone-heavy model with limited online portfolio management tools.

- Transparency: Individual metal prices are not listed on the website.

The Verdict: Birch Gold Group is the premier choice for everyday investors who want personalized guidance without the $50,000 "buy-in" required by other top-tier firms. Their "bespoke" approach and A+ reputation make them a safe entry point into the world of physical assets. However, investors must stay disciplined and focus on low-premium bullion to ensure their long-term math remains sound.

Compared to peers:

Augusta Precious Metals is often preferred for larger accounts ($50k+) due to more intensive economic education.

Goldco offers more aggressive "free silver" promotions but maintains a similar phone-heavy model.

Company Philosophy and Leadership

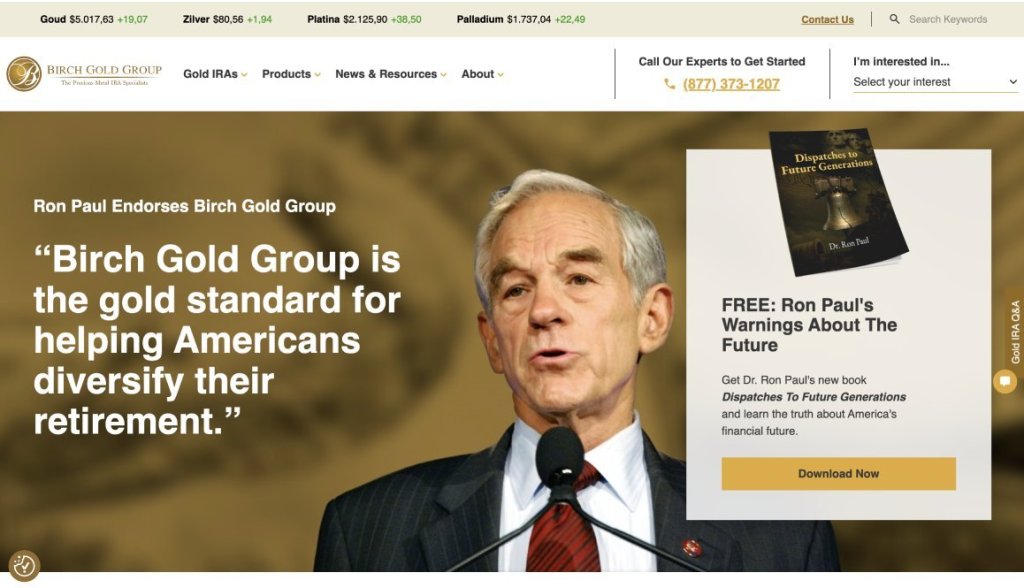

The company positions itself as a customer-centric business focused on transparency and customer education. Led by CEO Laith Alsarraf, Birch Gold Group has built a philosophy around "1-on-1 care," assigning a dedicated Precious Metals Specialist to every client to simplify the complexities of IRS regulations. Over the past decade, Birch Gold Group has built a reputation through high-profile media presence and endorsements from figures like Ron Paul and Megyn Kelly, which help attract conservative investors wary of traditional stock markets.

Yet, as with any investment firm, legitimacy hinges on regulatory compliance, customer feedback, and operational practices. It operates under strict IRS guidelines for precious metals IRAs, using approved custodians such as Equity Trust Company or STRATA Trust Company and depositories like Brinks Global Services or Delaware Depository.

Legitimacy and Industry Standing

Investors often ask whether Birch Gold Group is a safe bet in an industry sometimes plagued by scams. From what I've gathered through reviews and public records, it appears legitimate, having served over 29,000 customers since its inception. However, some recent 2026 reports warn about "incentive alignment" issues, where investors may be guided toward products that benefit the dealer more than the client. For now, let's break down what the company offers and how it stacks up.

The Track Record

Birch Gold Group has spent over a decade establishing itself as a "bespoke" service provider that remains accessible to those with smaller nest eggs. By 2026, it has become known for its "white glove" service, assisting with everything from the initial 401(k) review to the final physical placement of metals in a vault.

The company's longevity and consistent high marks from consumer advocacy groups suggest a stable operational foundation. Legitimacy is a core concern in this sector, where fly-by-night operations can vanish with clients' funds.

Ratings and Certifications

Better Business Bureau (BBB): Holds an A+ rating, with thousands of reviews averaging approximately 4.5 to 4.8 stars.

Business Consumer Alliance (BCA): Maintains a AAA rating, reflecting a high level of trust and minimal unresolved complaints.

Trustpilot: Consistently scores between 4.6 and 4.8 stars, with customers praising the "painless" rollover process.

Consumer Affairs: Features a 4.8-star average, with specific praise for their educational support for "novice" investors.

| Platform | Rating |

|---|---|

| Better Business Bureau (BBB) | Holds an A+ rating, with thousands of reviews averaging approximately 4.5 to 4.8 stars. |

| Business Consumer Alliance (BCA) | Maintains a AAA rating, reflecting a high level of trust and minimal unresolved complaints. |

| Trustpilot | Consistently scores between 4.6 and 4.8 stars, with customers praising the "painless" rollover process. |

| Consumer Affairs | Features a 4.8-star average, with specific praise for their educational support for "novice" investors. |

These ratings suggest a track record of reliability, though they're not infallible. The firm complies with IRS regulations for self-directed IRAs, ensuring that all physical assets are stored in secure, insured depositories rather than illegal "home storage" setups.

Reviewer's Note: Birch Gold is one of the few top-tier firms that allows a $10,000 minimum for IRAs, making them significantly more accessible than competitors like Augusta Precious Metals.

Products, Services, and The Rollover Process

Birch Gold Group specializes in gold and silver IRAs, allowing investors to roll over retirement funds into physical assets. The process starts with a "no-obligation" 2026 information kit, followed by the assignment of a specialist who handles the heavy lifting of paperwork.

Clients can transfer from a wide range of accounts including:

Traditional, Roth, SEP, and SIMPLE IRAs.

401(k), 403(b), and 457 plans.

Thrift Savings Plans (TSPs).

The rollover process is relatively quick, typically taking 48 to 72 hours to establish an account number and up to two weeks for full funding.

The Physical Asset Catalog

Beyond IRAs, Birch Gold offers cash accounts for direct, non-retirement purchases. Popular products include:

Gold: American Gold Buffalo, Gold American Eagle (including proofs), and various 99.5% pure bars.

Silver: Canadian Silver Maple Leaf, Silver American Eagle, and silver rounds.

Diversification: Unlike some specialists, Birch also offers platinum and palladium options, allowing for a more diversified four-metal portfolio.

The firm provides educational resources that explain the "pros and cons" of each metal, helping novices make informed decisions.

Storage and Security

Storage is mandated by IRS rules for IRA-held metals. Birch Gold works with multiple depositories, giving investors a choice in location. Investors can choose between segregated storage (separately housed) or commingled storage (shared vault space), depending on their budget and preference. For rollovers over $50,000, Birch Gold often waives the first year’s custodial and storage fees.

Detailed Fee Structure and Costs

Costs can make or break an investment in precious metals, where margins are tight. Birch Gold is known for a flat-fee custodial model that prevents costs from scaling with the size of your portfolio.

| Fee Type | Amount | Notes |

| IRA Minimum | $10,000 | Highly accessible compared to industry leaders. |

| Cash Minimum | $5,000 | For direct purchases for home delivery. |

| Annual Maintenance | $125 (Typical) | Flat fee for account record-keeping. |

| Annual Storage/Ins. | $100 to $110 | Standard cost for secure vaulting. |

| One-Time Setup | $50 | Covers the initial SDIRA establishment. |

Customer Experience: The Good and The Bad

Feedback from clients paints a mostly positive picture, particularly regarding the "patience" of the specialists. On Trustpilot, users frequently mention that they felt "respected" even as total novices. Consumer Affairs highlights that the "easy and painless" rollover is their primary selling point.

The Buyback Commitment

One aspect that bolsters Birch Gold's credibility is their buyback policy. While they state there are no guarantees of a buyback, they offer "first right of refusal" to purchase metals back at fair market rates and do not charge additional buyback fees. This provides a clear exit path for retirees needing cash distributions.

Addressing Recent Criticism

Despite high ratings, some 2026 reviews highlight structural risks.

The Premium Problem: Some analysts warn that Birch’s specialists may guide investors toward "exclusive" or "limited" coins that carry markups of 30% to 60%, which can put an account "underwater" on day one.

Limited Tracking: The platform has been criticized for having limited real-time performance tracking compared to more tech-forward digital brokers.

Pricing Fluctuations: Some users noted that while service is excellent, the lack of an online price list makes it difficult to "buy the dip" without multiple phone calls.

Overall, the volume of positive reviews outweighs negatives. The company’s focus on the "middle-class patriot" investor has created a very loyal customer base.