Top accounting software for small businesses, freelancers, and companies is essential. It helps manage finances, stay tax compliant, and promote growth. In 2025, the right accounting software can save you time, reduce errors, and provide real-time insights into your business’s financial health.

Modern accounting tools can help you automate invoicing, track expenses, and prepare for tax season. They offer solutions that fit your needs.

At Top10.compare, we have looked at the best bookkeeping software. We want to help you find the right one for your business. This includes cloud-based options and hybrid systems.

Best Accounting Software for Small Businesses

Oracle NetSuite – Best for for mid-sized to large enterprises

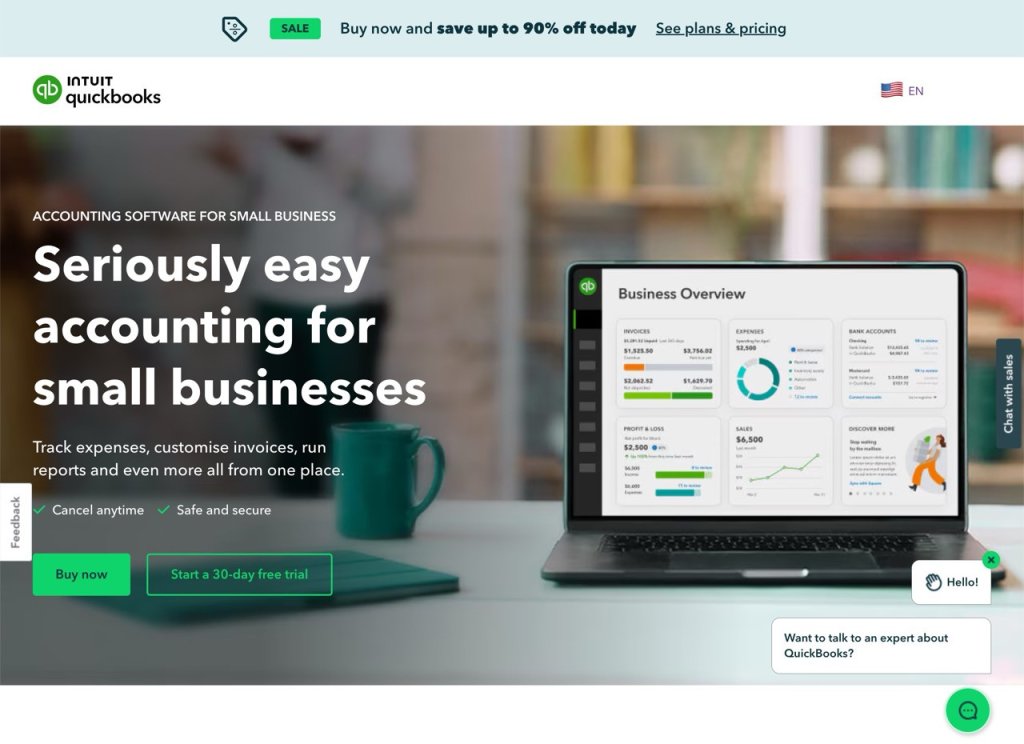

QuickBooks - Best online accounting software overall

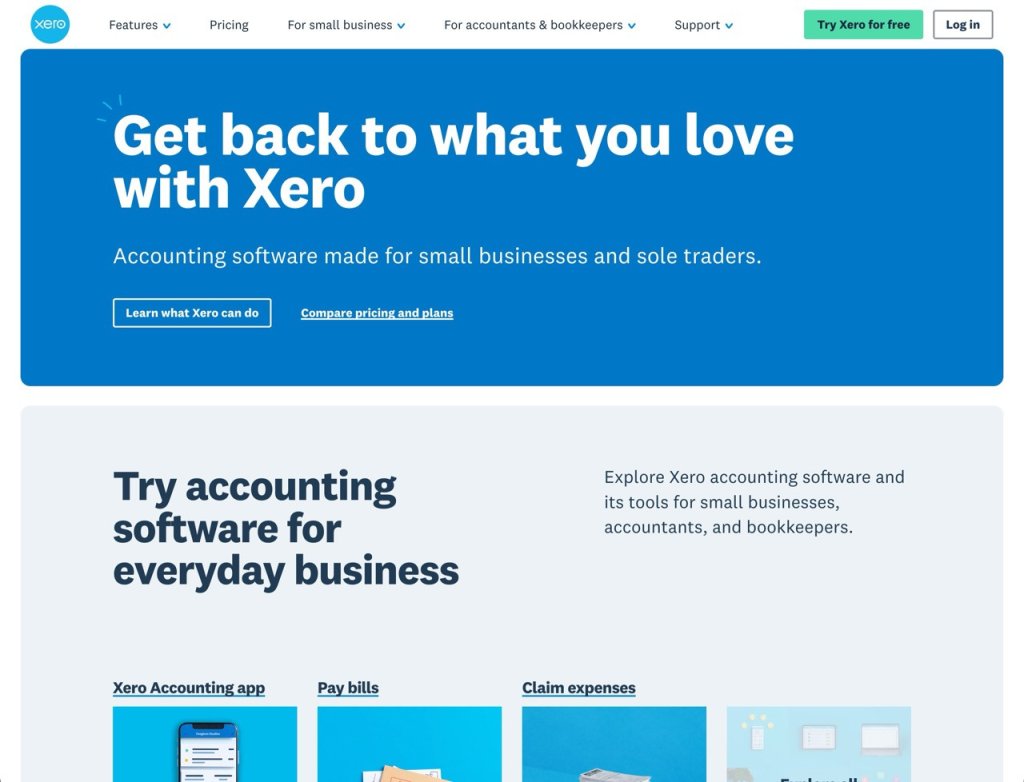

Xero - Best for growing businesses

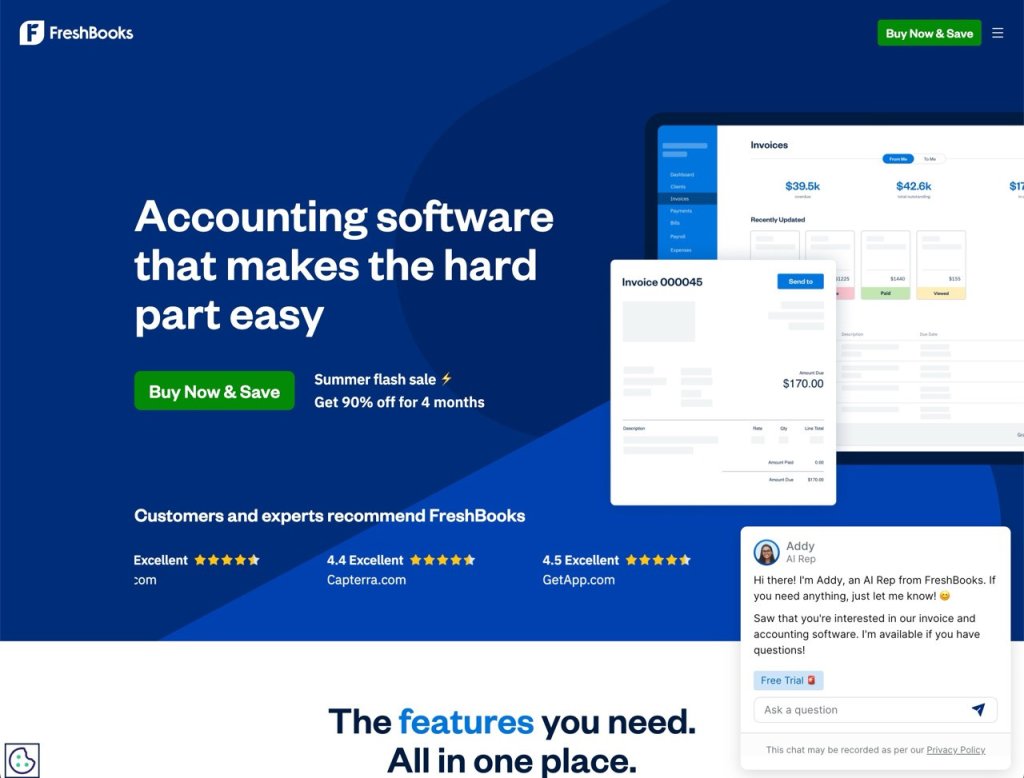

FreshBooks - Best for freelancers and service-based Businesses

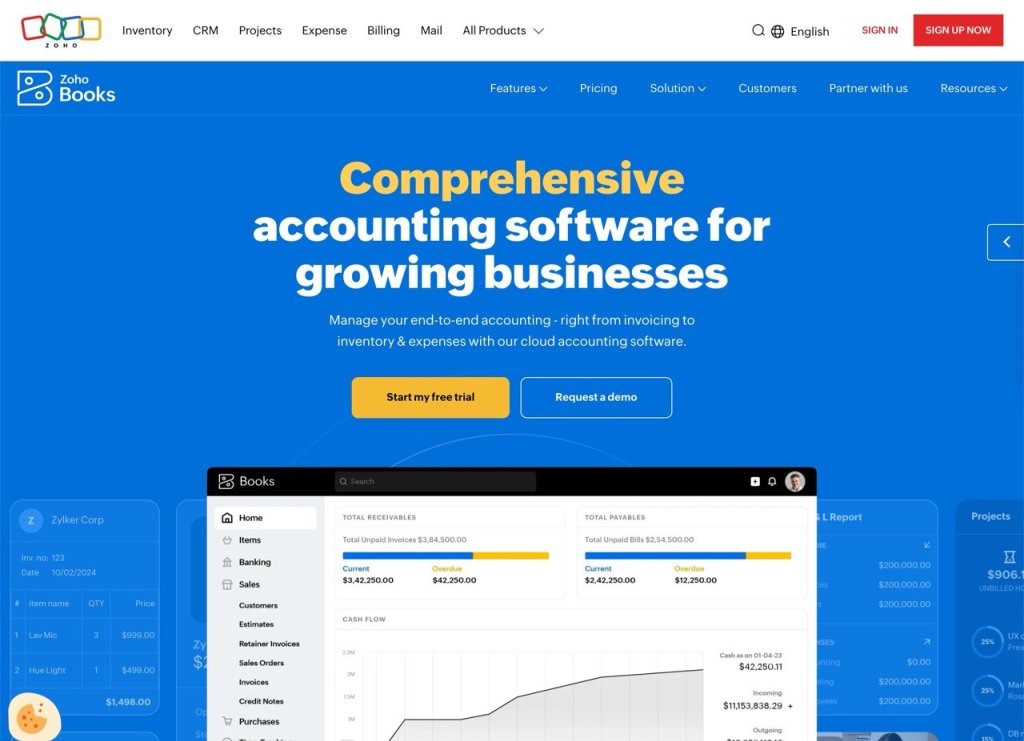

Zoho Books – Best for automation and integration

Wave – Best free Bookkeeping software

Melio – Best for streamlined AP/AR for modern SMBs

Patriot – Best for desktop users

Striven – Best for simplicity

Sage – Best accounting software for Mac users

NetSuite: Built for Scale. Built for AI. Built for What’s Next. Our absolute top recommendation.. Learn more about Oracle NetSuite

- Free product tour!

- Insight that’s real-time and predictive

- Control across every department

- Agility to shift with your customers and your market

- Productivity through smart automation

- Realtime dashboards

- Collaboration grounded in a shared source of truth

Good overall accounting tool and a solid choice for Small to Larger Businesses.. Learn more about Intuit Quickbooks

- PCMag's best accounting software

- Over 750 app integrations

- User-Friendly Interface

Xero stands out as the top choice for small to medium-sized businesses combining affordability with powerful tools. Learn more about Xero

- Top Deal: Get 90% off for 3 months!

- Connects with over 1,000 third-party apps

- Designed to grow with your business

Sage Intacct - Advanced financial management for Small to Large businesses. Get your Free Product Tour.. Learn more about Sage Intacct

- Trusted by over 24,500 businesses

- 250% ROI

- Automations, Real-time insights and Accounting-trained AI

Freshbooks - Makes invoicing, expense tracking, and time management incredibly easy. Learn more about Freshbooks

- Try it for Free

- Top Deal: Get 90% off for 3 months!

- The accounting features you need to succeed

- Exceptional Invoicing

- Save up to $7,000 per year

- Designed to grow with your business

- Simplify your financial tasks

Melio - An excellent choice for SMBs, freelancers seeking a platform to manage accounts payable and receivable. Learn more about Melio

- Flexible $0 Go plan with 5 free ACH transfers

- Real-time sync with your accounting tools

- Pay any bill by card to manage cash flow

Accounting and payroll software for small businesses. Learn more about Patriot

- Starting at $20/month with unlimited users

- Accessible for non-accountants

Striven - Ideal for growing companies that want more than just bookkeeping.. Learn more about Striven

- Extensive ERP solution

- Generate robust financial reports in seconds

Why Trust Top10.Compare?

Top10.Compare goes beyond basic lists. Our mission is to help you make smarter software choices by providing independent, transparent, and expert-driven comparisons. Unlike many generic review sites, we focus on practical testing, industry expertise, and real-world value.

We don’t just list products—we analyze them based on what matters to you. Whether you’re a freelancer, small business owner, or managing a growing team, you’ll find the right accounting software here for your needs.

How We Compare Accounting Software

Choosing the right accounting software can save you time, money, and frustration. That’s why we use a clear and proven methodology to create our rankings:

Features & Functionality

Does the software offer invoicing, expense tracking, tax tools, reporting, and integrations with other tools?

Ease of Use

Is the interface intuitive? Can beginners start easily, or is it geared more towards professionals?

Pricing & Value

We consider what you truly get for your money, not just the price tag.

Customer Support

How reliable and accessible is the helpdesk, chat, or phone support?

User Feedback

We combine our own testing with verified reviews from real users to spot patterns in customer satisfaction or complaints.

Security & Compliance

Especially with financial software, we evaluate security measures and data protection standards.

The Best Accounting Software Compared & Reviewed

Based on these criteria, we’ve selected the Top 10 accounting software tools currently available. This page gives you a more detailed look at each choice. We will cover its main strengths and possible drawbacks. Below you see the screenshot to help you understand the interface better.

| Oracle NetSuite | Xero | Freshbooks | Intuit Quickbooks | Sage Intacct | Patriot | Striven | Melio | |

|---|---|---|---|---|---|---|---|---|

| Logo |

|

|

|

|

|

|

|

|

| Overall Rating |

|

|

|

|

|

|

|

|

| Usability | 9.0 | 9.5 | 9.5 | 8.0 | 9.0 | 8.5 | 8.4 | 9.0 |

| Features | 10.0 | 9.0 | 9.0 | 8.5 | 9.0 | 8.0 | 8.5 | 8.2 |

| Integrations | 10.0 | 9.0 | 8.5 | 8.5 | 8.0 | 7.0 | 8.6 | 8.0 |

| Pricing | 8.5 | 9.5 | 9.5 | 9.0 | 9.0 | 8.5 | 7.8 | 9.5 |

| Support | 9.0 | 8.5 | 9.5 | 8.0 | 8.0 | 7.5 | 7.5 | 7.5 |

| Website | Visit site | Visit site | Visit site | Visit site | Visit site | Visit site | Visit site | Visit site |

1. QuickBooks Online – Best Overall for Small Businesses

QuickBooks Online by Intuit is a complete, cloud-based accounting tool. People recognize it for its strong features and easy-to-use design. It provides tools for invoicing, tracking expenses, and creating financial reports. This makes it great for small and medium-sized businesses.

Pros

- Extensive integration with over 750 apps

- Strong reporting and analytics capabilities

- User-friendly interface

Cons

-

Higher pricing tiers compared to some competitors

-

Limited customization in lower-tier plans

Best for: Small to medium-sized businesses seeking a comprehensive accounting solution.

2. Xero – Best for Growing Businesses

Xero is a cloud-based online accounting software known for its scalability and user-friendly design. It offers features like bank reconciliation, invoicing, and inventory management, making it suitable for growing businesses.

Pros

- Unlimited users on all plans

- Over 1,000 third-party app integrations

- Real-time financial reporting

Cons

-

Limited customer support options

-

Some advanced features require higher-tier plans

Best for: Businesses planning to scale and requiring multi-user access.

3. FreshBooks – Best for Freelancers and Service-Based Businesses

FreshBooks is a cloud-based accounting software known for its scalability and user-friendly design. It offers features like bank reconciliation, invoicing, and inventory management, making it suitable for growing businesses.

Pros

- Easy-to-use interface

- Automated invoicing and payment reminders

- Time tracking and project management features

Cons

-

Limited reporting capabilities

-

Additional cost for multiple users

Best for: Freelancers and small teams needing straightforward accounting tools.

4. Zoho Books – Best for Automation and Integration

Zoho Books is an affordable accounting solution offering strong automation and integration capabilities. Seamlessly integrated with other Zoho apps, providing a unified platform for business operations.

Pros

- AI-powered financial insights

- Automated workflows and approvals

- Multi-currency support

Cons

-

Some advanced features require higher-tier plans

-

Limited third-party integrations outside the Zoho ecosystem

Best for: Businesses already using Zoho products or seeking automation in accounting.

5. Wave – Best Free Bookkeeping Software

Wave offers a free, cloud-based accounting solution ideal for small businesses and freelancers. It includes features like invoicing, expense tracking, and receipt scanning.

Pros

- Completely free for core features

- User-friendly interface

- No hidden fees

Cons

-

Limited customer support

-

Advanced features like payroll require paid add-ons

Best for: Freelancers and small businesses seeking a cost-effective accounting solution.

6. Melio – Smart AP/AR for Modern SMBs

Melio is a cloud-based payment platform designed to streamline accounts payable (AP) and accounts receivable (AR) processes for small to medium-sized businesses (SMBs), freelancers, and accountants.

Pros

- No fixed cost to start – Go plan is $0 with 5 free ACH transfers each month

- Global reach – pay vendors in USD or their local currency across 85+ countries (vendors don’t need a Melio account)

- Robust workflow tools featuring approval layers, batch pay, W 9 capture, 1099 e file, and more

Cons

-

After the allowance, ACH costs $0.50 each; frequent payers need Core+ plans

-

Each international payment is $20 (+ conversion fee if paying in vendor’s local currency)

-

Phone support is only available in the Boost and Unlimited plans; other plans rely on chat/email

Best for: Businesses seeking efficient AP/AR management, particularly when making international payments or optimizing cash flow through card-based expenses.

7. Oracle NetSuite – Best for for mid-sized to large enterprises

Oracle NetSuite is designed specifically for for mid-sized to large enterprises, offering tools for invoicing, expense tracking, and time management.

Pros

- All ine one package

- Automated tax calculations

- Project profitability tracking

Cons

-

Limited scalability for larger businesses

-

Fewer integrations compared to competitors

Best for: Freelancers and small business owners seeking straightforward accounting tools.

8. Patriot – Best for Desktop Users

Patriot combines the reliability of desktop software solution with cloud connectivity. Ideal for businesses that prefer desktop solutions but require cloud features like data backup and remote access.

Pros

- Advanced inventory and job costing tools

- Robust reporting capabilities

- Integration with Microsoft 365

Cons

-

Only available for Windows

-

No mobile app

Best for: Businesses needing a desktop accounting solution with cloud features.

9. Striven – Best for Simplicity

Striven offers a straightforward accounting solution for small businesses. It provides essential features like invoicing, expense tracking, and reporting without unnecessary complexity.

Pros

- Simple and intuitive interface

- Multi-currency support

- Affordable pricing

Cons

-

Limited advanced features

-

Fewer integrations compared to competitors

Best for: Small business owners seeking a no-frills accounting solution.

10. Sage – Best Accounting Software for Mac Users

Sage is a desktop accounting software tailored for Mac users. It offers a comprehensive set of tools for managing business finances, including invoicing, payroll, and inventory management.

Pros

- Comprehensive feature set

- Customizable reports

- One-time purchase option

Cons

-

Limited cloud capabilities

-

Requires manual updates

Best for: Mac-based businesses preferring desktop accounting software.

Types of Accounting Software: Cloud, Desktop, and Hybrid Solutions

Online Accounting software comes in various forms, each suited to different business needs. Cloud accounting software, such as Xero and Zoho Books, is flexible and easy to access. You can manage your finances from any device with an internet connection.

Desktop accounting software offers strong features for businesses that prefer on-premise systems. Hybrid solutions, like Sage 50cloud Accounting, mix desktop reliability with cloud access for remote use.

Specialized tools like Melio focus on payment processing, making them ideal for businesses prioritizing accounts payable and receivable workflows. Understanding these types ensures you choose the right accounting tools for your operations.

Key Features to Look for in Accounting Software

Choosing the best accounting software starts with knowing which features truly support your business needs. Here is a list of the basic and advanced tools to consider. These tools can help you manage daily finances or plan for future growth.

1. Invoicing That Keeps Cash Flow Moving

A solid invoicing system helps you get paid faster and keeps your cash flow healthy. Look for platforms that let you create professional invoices quickly, support recurring billing, and send automated payment reminders.

FreshBooks shines with customizable invoice templates and built-in payment options like Stripe and PayPal — great for freelancers.

Xero’s Growing and Established plans allow unlimited invoices, while the Early plan limits you to five per month — something to consider if you’re billing frequently.

QuickBooks Online supports progress invoicing, ideal for contractors and service-based businesses that bill in stages.

2. Smart Expense Tracking

Keeping an eye on expenses is key for budgeting and tax deductions. The best accounting tools connect to your bank automatically. They categorize transactions and let you upload receipts easily.

Zoho Books and QuickBooks Online both use AI to intelligently categorize spending.

QuickBooks’ Intuit Assist even recommends potential tax deductions based on your habits.

Patriot Accounting offers secure cloud-based receipt storage but lacks the automation features of larger platforms.

3. Bank Reconciliation Made Easy

Bank reconciliation ensures your books match your actual bank accounts — essential for financial accuracy and tax reporting. Look for tools with smart matching features that simplify this process.

Xero automatically imports transactions and suggests matches, though you may need to reconnect occasionally because of the bank security.

Patriot Accounting includes reconciliation for up to 10 accounts in its Premium plan.

NetSuite offers powerful reconciliation features tailored for enterprises handling intercompany transactions.

4. Insightful Financial Reporting

Robust reporting helps you understand how your business is doing and where it’s headed. Prioritize software that includes customizable reports such as profit and loss, balance sheets, and cash flow forecasts.

Sage 50cloud is special because it has over 100 built-in reports. These include accounting budget vs. actuals. This makes it great for contractors and retail businesses.

QuickBooks Online Advanced adds AI-powered cash flow projections.

Zoho Books includes over 40 reports, with more flexibility in higher-tier plans for custom dashboards.

5. Streamlined Tax Preparation

Good bookkeeping software should make tax time easier. Features to look for include automatic tax calculations, 1099 contractor forms, and compliance tools tailored to your country.

QuickBooks Online integrates with TurboTax for seamless U.S. tax filing and calculates sales tax based on location.

FreshBooks simplifies freelancer taxes with built-in 1099 reporting.

Zoho Books supports Making Tax Digital (MTD) for UK-based businesses, ensuring accurate VAT returns.

Patriot Accounting generates 1099/1096 forms with optional e-filing, making it a good fit for U.S. small businesses.

6. Advanced Tools for Growing Businesses

As your business expands, your software should grow with you. Look for features like multi-currency support, inventory tracking, and project management.

NetSuite handles over 190 currencies and supports multi-subsidiary structures — ideal for international growth.

Sage 50cloud Quantum includes inventory management with low-stock alerts and serial number tracking.

Xero’s Established plan includes project tracking to monitor job profitability.

Zoho Books offers project budgeting and inventory tools in higher plans, striking a balance between features and affordability.

7. Automation and AI Efficiency

Time-saving automation and intelligent insights can significantly reduce manual work and improve decision-making.

QuickBooks Online uses Intuit Assist to automate invoicing and forecast future trends.

Xero leverages AI to learn from your spending habits and improve transaction categorization.

Melio automates bill payments — helping you stay on top of vendor invoices without a monthly fee.

These features ensure your accounting software meets both immediate needs and long-term goals, whether you’re managing daily finances or planning for expansion.

Final Thoughts

Choosing the right accounting software is important. This applies to freelancers, startups, and large companies alike. The right software can save you time, make your finances more accurate, and grow with your business. Prioritize the tools that fit your current workflow — and prepare you for what’s next.

Benefits of Accounting Software for Different Users

Accounting software isn’t one-size-fits-all — the right solution depends on your business model, size, and industry. Below, we explore how various types of users can make the most of accounting tools tailored to their unique needs.

1. Small Businesses: Scalable Tools That Grow With You

Small businesses need cost-effective software that’s easy to use and built to scale. The best platforms support team collaboration, project budgeting, and cash flow tracking — all while staying within budget.

Xero is great bookkeeping software for growing teams. Every plan allows unlimited users. The Established plan includes project tracking. This feature helps service-based businesses manage their profits.

Zoho Books has a free plan for businesses that make less than $50,000 a year. Paid plans start at $15 per month. These plans include features like recurring invoicing and alerts for budget overruns.

💡 Example: A boutique retail shop can use Zoho Books to monitor inventory spending to stay within budget. A digital agency might use Xero to manage multiple projects and assign tasks to team members.

2. Freelancers: Fast Invoicing and Time Tracking

Freelancers need software that simplifies client billing, tracks time, and automates payment reminders — so they can focus on their craft, not paperwork.

FreshBooks lets you make sleek, branded bills that have "Pay Now" buttons for PayPal or Stripe built right in. This makes it easy to get paid quickly.

Time tracking is available on all plans, letting freelancers log billable hours and convert them directly into invoices.

FreshBooks also generates 1099 reports, easing tax prep for contractors and solo professionals.

💡 Example: A freelance web designer can track project hours, send invoices directly from FreshBooks, and receive payments faster — all while keeping tax info organized in one place.

3. Nonprofits: Budget-Friendly Solutions for Mission-Driven Work

Nonprofits need simple, affordable tools that help manage donations, comply with regulations, and ensure transparency with donors and stakeholders.

Patriot Accounting starts at $20/month and includes unlimited users — ideal for teams with board members and volunteers.

Built-in 1099 creation, sales tax calculation, and basic financial reports make compliance and expense tracking easier.

💡 Example: A small nonprofit running local events can use Patriot to pay vendors, track expenses, and generate end-of-year 1099 forms — all on a tight budget.

4. Enterprises: Advanced Features for Complex Operations

Larger companies — especially those operating internationally — need robust tools for managing multiple entities, currencies, and teams.

Oracle NetSuite supports over 190 currencies, 27 languages, and offers integrated modules for accounting, CRM, inventory, and HR.

Its advanced general ledger and real-time reporting help enterprises consolidate data across subsidiaries.

💡 Example: A manufacturing group with offices in North America and Europe can use NetSuite to manage intercompany transactions, track inventory across multiple warehouses, and generate comprehensive reports for investors.

5. Retail and Product-Based Businesses: Real-Time Inventory Insights

Retailers and businesses that sell physical products rely heavily on inventory tracking to avoid stockouts and maximize sales.

Sage 50cloud includes advanced inventory management, with features like reorder alerts, serial number tracking, and cloud access (Quantum plan).

It also integrates with sales reporting tools, helping businesses identify trends and optimize stock levels.

💡 Example: An electronics store can use Sage 50cloud to set reorder points for high-demand items, track serial numbers for warranty purposes, and run sales reports to identify bestsellers.

Final Thoughts: Matching Software to Your Business Type

Whether you’re a solo freelancer, nonprofit, startup, or multinational corporation. The right accounting software can make a meaningful difference in how efficiently you manage finances. By choosing software that fits your specific business model, you’ll save time, reduce manual errors, and improve financial visibility.

Comparison of Top Bookkeeping Software in 2025

| Software | Best for | Key Features | Price/Month (Starting) | Free Trial |

|---|---|---|---|---|

| QuickBooks Online | Comprehensive tax management | AI forecasting, TurboTax integration | $35 (Simple Start) | 30 days |

| Xero | Collaboration, scalability | Unlimited users, project tracking | $15 (Early) | 30 days |

| Zoho Books | Budget-friendly planning | Free plan, budget overrun alerts | $0 (Free), $15 (Paid) | 14 days |

| Sage 50cloud | Detailed financial planning | Advanced budgeting, inventory | $62.50 (Pro Accounting) | 30 days |

How Accounting Software Helps with Tax Preparation and Compliance

Tax preparation is a critical task for any business, and accounting software can make it seamless. QuickBooks Online calculates sales tax and integrates with TurboTax for direct filing, a unique feature for U.S. businesses, and automatically calculates sales tax based on location.

FreshBooks generates 1099 reports, making it a favorite for freelancers, while Zoho Books supports Making Tax Digital (MTD) compliance in the UK, ensuring VAT returns are accurate. Patriot Accounting offers 1099/1096 form generation with optional e-filing, catering to small U.S.-based businesses. By automating tax calculations and organizing expenses, these tools help you stay compliant and avoid penalties, making tax season stress-free.

Accounting Software Trends to Watch in 2025

In 2025, accounting software is evolving with new trends that enhance functionality:

AI-Driven Insights: QuickBooks Online uses AI for cash flow forecasting, helping businesses predict financial trends.

Mobile Access: Xero and FreshBooks offer robust mobile apps, updated in 2025, for managing finances on the go.

Enhanced Security: Platforms like NetSuite and Zoho Books prioritize 256-bit SSL encryption and role-based access to protect data.

Automation: Tools like Melio automate payment workflows, while Zoho Books streamlines recurring invoices and bank reconciliation.

These trends ensure accounting software remains a vital tool for modern businesses, keeping you ahead of the curve.

How to Choose the Right Accounting Software for Your Business

Choosing accounting software is about more than features or price. You need a solution that fits your workflow. The right software will grow with your business and remove financial guesswork. Here’s how to navigate the process with confidence.

✅ 1. Define what you actually need

Before comparing platforms, ask yourself:

What kind of business are you running? (Freelancer, retail store, nonprofit, global enterprise?)

What’s your top priority? Invoicing? Inventory? Budgeting? Tax compliance?

Examples:

A freelance writer may need simple invoicing and time tracking — FreshBooks fits perfectly.

A product-based business managing stock will benefit from Sage 50cloud’s advanced inventory features.

For multi-currency support or money tracking, multinational corporations or nonprofit organizations should think about solutions like Xero, NetSuite, or Patriot Accounting.

By clearly identifying your operational needs, you’ll avoid paying for features you don’t need. Or missing those you do.

💰 2. Balance Your Budget and Feature Requirements

Pricing models vary widely across platforms. While some offer free tiers, others can get expensive as your team grows.

| Platform | Starting Price | Highlights |

|---|---|---|

| Zoho Books | Free (<$50k revenue) | Affordable plans starting at $15/month |

| Patriot Accounting | From $20/month | Unlimited users, low entry cost |

| QuickBooks Online | $35–$235/month | Scales with growing businesses |

| Sage 50cloud | From $58.92/month | Add-ons and extra users cost extra |

🔍 3. Focus on Core and Advanced Features

Make a checklist of features your business needs now and in the future.

Key Features to Compare:

Invoicing & payments – FreshBooks, Zoho Books

Inventory & job costing – Sage 50cloud, NetSuite

Project tracking – Xero (Established), Zoho Books (Professional+)

Tax automation – QuickBooks Online with TurboTax

AI-driven forecasting – QuickBooks Advanced

Multi-currency & subsidiaries – Xero, NetSuite

Not every feature will apply to your business today, but it’s smart to think ahead—especially if growth is on your radar.

🧪 4. Try Before You Buy

Most top platforms offer a free trial. Use it.

Test:

Navigation: Is the interface intuitive?

Reporting: Can you generate P&L or cash flow reports easily?

Setup: Is onboarding straightforward?

Trial Options to Explore:

Xero: 30-day full-feature trial

QuickBooks Online: 30-day access

Zoho Books: 14-day Premium plan trial

Sage 50cloud: Includes TestDrive demo + 30-day trial

🧠 Use Case: A service-based firm can try Xero’s Budget Manager to forecast cash flow, while a freelancer can test FreshBooks’ time tracking to streamline client billing.

🔌 5. Review Integrations and Workflow Compatibility

Accounting software is more powerful when it integrates with your existing stack—think CRM, payroll, e-commerce, or payment systems.

Xero connects with over 1,000 apps (e.g., Shopify, HubSpot).

QuickBooks Online supports 750+ integrations, including PayPal, Square, and Gusto.

Zoho Books integrates seamlessly with other Zoho products (CRM, Projects).

Patriot Accounting offers fewer integrations but syncs well with Patriot Payroll.

Check whether your bank is supported (via Plaid or direct sync), and whether the tool plays well with your accountant’s systems.

🧑💻 6. Evaluate Support and Long-Term Scalability

Customer support can make or break your experience—especially when deadlines loom.

| Platform | Support Availability | Scalable For… |

|---|---|---|

| Patriot Accounting | US-based phone/chat support | Small businesses, nonprofits |

| Xero | 24/7 online support | Teams of any size (unlimited users) |

| NetSuite | Enterprise-level support (costly) | Multinational, complex organizations |

📣 7. Research Reviews and Real-World Feedback

Don’t rely solely on product pages—read independent reviews, case studies, and side-by-side comparisons.

💡 Quick Tips:

Check user ratings on Capterra or G2

Read our expert reviews of Xero, Zoho Books, FreshBooks, and QuickBooks Online

Ask peers in your industry what works for them

Check if the software supports accountant access (great for tax season!)

Final Takeaway: Choose with Confidence

The best accounting software isn’t just feature-rich—it’s the one that aligns with your workflow, budget, and growth plans. Use free trials, compare use cases, and don’t be afraid to ask questions. Investing a little time now will save you hours down the road.

Summary

At top10.compare, we’re committed to helping you find the best accounting software for your business. Whether you’re a small business owner seeking scalability or a freelancer needing invoicing tools, or an enterprise managing global operations. Our detailed reviews of top platforms like QuickBooks Online, Xero, Zoho Books, and Sage 50cloud provide the insights you need.

Explore our reviews, compare features, and start your free trial today to simplify your financial management and thrive in 2025. Are you ready to take control of your finances? Contact us for personalized recommendations or sign up for our newsletter for the latest accounting software updates.

FAQs

Accounting software is a digital tool designed to help individuals and businesses manage their financial transactions, track income and expenses, generate invoices, and prepare reports like balance sheets and profit & loss statements.

Most bookkeeping software automates repetitive tasks, such as expense categorization or tax calculations, making financial management easier and less error-prone. Some tools also integrate with banks and payment processors to automatically import transactions, giving you a real-time overview of your finances.

The best accounting software includes features that match your business needs. Key features to look for include:

- Invoicing and billing: Easily create and send professional invoices.

- Expense tracking: Monitor your spending and categorize transactions.

- Financial reporting: Generate reports to understand cash flow, profits, and expenses.

- Tax preparation tools: Simplify filing taxes with built-in tax reports.

- Multi-currency support: Useful for businesses dealing with international clients.

- Integrations: Connect with other tools like PayPal, Stripe, or your bank account.

For growing businesses, features like payroll management and project-based accounting may also be essential.

The cost of accounting software varies widely depending on the features you need.

- Basic plans for freelancers or small businesses typically start around $10 to $20 per month.

- More advanced packages with features like payroll, inventory management, or multiple users can cost between $30 and $70 per month.

- Enterprise-level solutions for larger businesses may cost $100+ per month or require custom pricing.

Many providers also offer free trials or money-back guarantees, so you can test the software before committing.

Several free accounting software tools are ideal for small businesses or freelancers. One of the most popular is Wave Accounting, which offers free invoicing, expense tracking, and financial reporting.

Other good free options include:

- ZipBooks: Free plan with invoicing and basic reports.

- Akaunting: Open-source accounting software with cloud and desktop versions.

While free software is great for basic needs, paid plans often provide better support, automation, and advanced features as your business grows.