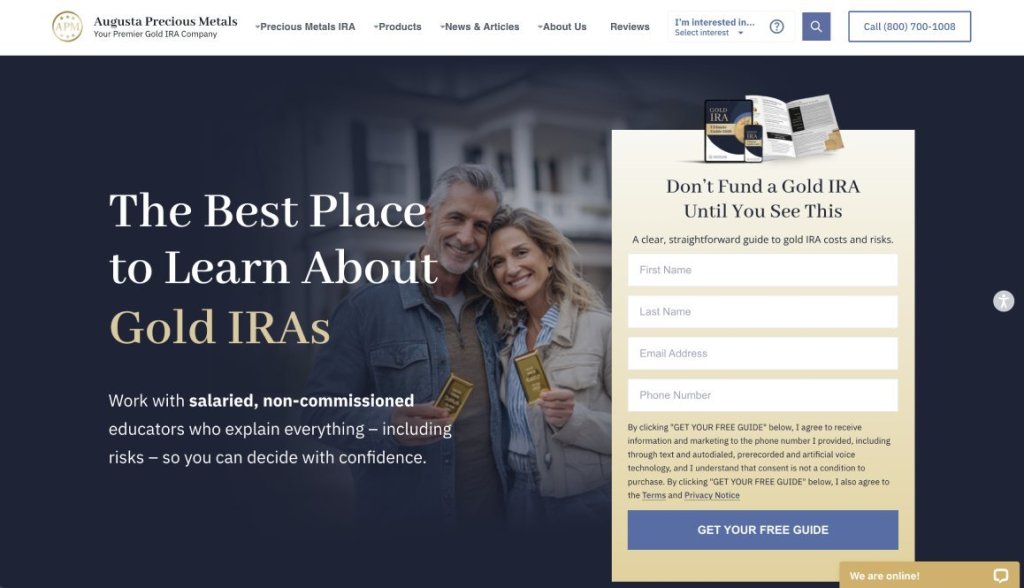

Augusta Precious Metals stands out as a prominent player in the precious metals IRA market, catering to investors who want to diversify their retirement portfolios with gold and silver.

Augusta Precious Metals: A 2026 Investor Review

Augusta Precious Metals stands out as a prominent player in the precious metals IRA market, catering to investors who want to diversify their retirement portfolios with gold and silver. Founded in 2012 by CEO Isaac Nuriani, this company has established a unique footprint in the industry by moving away from transactional sales and toward a service-oriented model.

It primarily serves individuals looking to roll over existing retirement accounts like 401(k)s or IRAs into self-directed precious metals accounts, but with a specific focus on high-net-worth individuals and serious retirees.

As economic uncertainties linger in 2026, with inflation concerns and market volatility, many retirees and high-net-worth individuals turn to firms like this one for asset protection. But does it deliver on its promises? This review draws from multiple sources to assess its operations, strengths, and potential drawbacks.

Final Comparison and Verdict

Pros at a Glance

-

Education: One-on-one conferences with a Harvard-trained economist.

-

Transparency: No hidden fees and a strict "no gimmicks" policy regarding free silver.

-

Support: Lifetime account service with specialized departments for every stage.

-

Ethics: High ratings from all major watchdogs and a no-pressure sales model.

Cons at a Glance

- Accessibility: High $50,000 minimum investment.

- Product Catalog: Focuses strictly on gold and silver; no platinum or palladium for IRAs.

- Setup Time: Asset transfers for account set-up can sometimes take up to a month.

The Verdict: Augusta Precious Metals is the premier choice for sophisticated, high-net-worth investors who prioritize education and compliance over flashy promotions. Their $50,000 minimum makes them a "specialist" firm, but for those who meet the threshold, the level of transparency and lifetime support is currently unmatched in the 2026 market.

Compared to peers:

Goldco offers more aggressive promotional incentives like $10,000 in free silver.

American Hartford Gold provides much lower entry points for smaller investors.

Noble Gold is often cited for having more diverse storage locations.

Company Philosophy and Leadership

The company positions itself as a family-owned business focused on transparency and customer education. Isaac Nuriani, the CEO, has built the firm on a foundation of strict compliance and long-term partnership rather than quick sales. A central figure in their philosophy is Devlyn Steele, a Harvard-trained economist and Director of Education, who leads the firm’s signature one-on-one web conferences. Over the past decade, Augusta Precious Metals has built a reputation through endorsements from figures like Joe Montana, which help attract conservative investors wary of traditional stock markets.

Yet, as with any investment firm, legitimacy hinges on regulatory compliance, customer feedback, and operational practices. It operates under strict IRS guidelines for precious metals IRAs, using approved custodians like Equity Trust Company or GoldStar Trust and depositories such as Delaware Depository or other top-tier insured facilities.

Legitimacy and Industry Standing

Investors often ask whether Augusta Precious Metals is a safe bet in an industry sometimes plagued by scams. From what I've gathered through reviews and public records, it appears legitimate, free of major lawsuits or scandals. It is frequently cited as a leader in transparency because it avoids the "free silver" gimmicks common among competitors, which can often hide inflated margins. For now, let's break down what the company offers and how it stacks up.

The Track Record

Isaac Nuriani launched Augusta Precious Metals with the goal of providing an "education-first" alternative to the aggressive sales tactics seen in the bullion market. By 2026, the firm has positioned itself as the "#1 Gold IRA Company" according to several industry analysts, partly due to its "lifetime support" commitment. Every customer is supported by five specialized internal departments—ranging from IRA processing to economic analytics—ensuring a streamlined experience.

The company's commitment to ethics earned it recognition as the "Most Transparent" provider by Investopedia and "Best Overall" by Money Magazine for multiple consecutive years. Legitimacy is a core concern in this sector, where fly-by-night operations can vanish with clients' funds.

Ratings and Certifications

| Platform | Rating |

|---|---|

| Better Business Bureau (BBB) | Holds an A+ rating and is accredited, with a remarkably clean record regarding customer complaints. |

| Business Consumer Alliance (BCA) | Maintains a AAA rating, the highest possible score from the organization. |

| Trustpilot and Google | Consistently receives 4.9 out of 5 stars across hundreds of verified customer reviews. |

| Consumer Affairs | Boasts a perfect 5-star rating from satisfied investors. |

These ratings suggest a track record of reliability, though they're not infallible. The firm complies with IRS regulations for self-directed IRAs, ensuring that all physical assets are stored in secure, insured depositories where creditors cannot access customer investments.

Reviewer's Note: Augusta’s hallmark is the one-on-one web conference. This session is designed to warn investors about "Gimmicks and Pitfalls" in the gold industry, which establishes a level of trust that few other dealers manage to replicate.

Products, Services, and The Rollover Process

Augusta Precious Metals specializes in gold and silver IRAs, allowing investors to roll over retirement funds into physical assets. The process starts with an educational phase, followed by a personal agent connection to guide the client through account setup.

Account Eligibility

Clients can transfer from a wide range of accounts including:

Traditional IRAs and Roth IRAs.

401(k)s, 403(b)s, and 457(b) plans.

Thrift Savings Plans (TSPs).

The IRA processing team handles roughly 95% of the paperwork on behalf of the client, coordinating directly with the custodian to ensure a smooth transfer of funds.

The Physical Asset Catalog

Beyond IRAs, Augusta offers cash accounts for direct, non-retirement purchases of coins and bars. Popular products include:

| Gold | American Eagle coins, American Buffaloes, and South African Krugerrands. |

|---|---|

| Silver | Canadian Maple Leafs, Silver American Eagles, and 100-oz silver bars. |

| Premium Options | Unique items like the St. Helena Gold Sovereign and Arctic Fox silver coins for those seeking specialty items. |

The firm provides educational resources that go beyond simple sales brochures, focusing on macroeconomic data and geopolitical threats to general investments.

Storage and Security

Storage is mandated by IRS rules for IRA-held metals. Augusta utilizes the Delaware Depository and other secure, privately owned facilities. Investors can choose between segregated storage (keeping their metals in a private box) or pooled storage. For qualifying accounts, Augusta often offers a "10 Years Fee-Free" promotion, covering storage and custodian costs for up to a decade.

Detailed Fee Structure and Costs

Costs can make or break an investment in precious metals, where margins are tight. Augusta is known for a flat fee structure that is highly competitive for larger accounts.

| Fee Type | Amount | Notes |

| IRA Minimum | $50,000 | One of the highest in the industry. |

| Cash Minimum | $50,000 | Required for direct cash purchases. |

| Annual Maintenance | $75 to $125 | Varies slightly based on account balance. |

| Annual Storage | $100 to $150 | $100 for pooled; $150 for segregated. |

| One-Time Setup | $50 | Covers the establishment of the SDIRA. |

Augusta is praised for its transparency regarding spreads. While they do not list prices on their website, they confirm all bullion and premium prices by phone before locking them in. They also maintain a 7-Day Price Protection Program for premium products and do not add hidden management fees.

Customer Experience: The Good and The Bad

Feedback from clients paints a mostly positive picture, especially regarding the lack of sales pressure. On Trustpilot, users frequently mention that they felt "educated rather than sold". Money Magazine has consistently ranked them as the "Best Overall" for their ethics and customer experience.

The Buyback Commitment

One aspect that bolsters Augusta's credibility is their buyback guarantee. They offer a satisfaction guarantee and a published buyback program that allows investors to liquidate their holdings with confidence. This is critical for retirees who eventually need to transition their physical gold back into cash for distributions.

Addressing Recent Criticism

While the feedback is overwhelmingly positive, there are a few points of contention in the 2026 market.

The High Minimum: The $50,000 minimum investment is a significant barrier for smaller investors, effectively ruling out those just beginning their retirement journey.

Premium Coin Markups: As with all dealers, "premium" coins carry higher markups than standard bullion. Reviewers advise investors to ask for written pricing to understand the exact spread before funding.

Liquidation Misunderstandings: Some users have expressed frustration when they realize that selling back metals might result in a price closer to the "spot" value, despite having paid a retail premium initially.

Overall, the volume of positive reviews outweighs negatives. The company’s long history of zero complaints on the BBB and BCA is nearly unique in the industry.