Goldco, founded in 2006 and headquartered in Calabasas, California, is a leading precious metals dealer specializing in self-directed IRAs. With over $3 billion in metals placements and an A+ BBB rating, they offer guided rollover support and extensive educational resources for retirement investors.

Goldco: A 2026 Investor Review

Goldco stands out as a prominent player in the precious metals IRA market, catering to investors who want to diversify their retirement portfolios with gold and silver. Founded in 2006 by CEO Trevor Gerszt, this Los Angeles-based company has grown rapidly into one of the largest gold retailers in the United States. It primarily serves individuals looking to roll over existing retirement accounts like 401(k)s or IRAs into self-directed precious metals accounts.

As economic uncertainties linger in 2026, with inflation concerns and market volatility, many retirees and high-net-worth individuals turn to firms like this one for asset protection. But does it deliver on its promises? This review draws from multiple sources to assess its operations, strengths, and potential drawbacks.

Final Comparison and Verdict

Pros at a Glance

-

Customer Service: Award-winning support with dedicated account representatives.

-

Reputation: Over 19 years in business with a clean record of legal disputes.

-

Onboarding: Fast, expert guidance for 401(k) and IRA rollovers.

-

Incentives: Frequent promotions, including fee waivers and "free" silver on qualifying orders.

-

Over $3 billion in metals placements with proven track record

-

A+ BBB rating, 4.8/5 Trustpilot from 1,500+ reviews

-

Free educational materials for beginners

Cons at a Glance

- Asset Markup: Heavy focus on premium coins which may carry significantly higher spreads than bullion.

- Pricing: No real-time online price list; requires phone interaction.

- Minimums: The $25,000 target for IRAs may be too high for smaller investors.

The Verdict: Goldco is a solid choice for investors seeking a "white glove" experience and a reputable firm to handle the complexities of an IRA rollover. It is especially strong for those with at least $25,000 who prioritize customer service over digital self-service. However, investors should be vigilant about the specific coins they choose, as high premiums on specialty items can significantly impact long-term gains.

Compared to peers

American Hartford Gold often has lower minimums for smaller portfolios.

Birch Gold Group is cited for better upfront fee transparency online.

Augusta Precious Metals is often preferred for large accounts due to their detailed 1-on-1 education.

Company Philosophy and Leadership

The company positions itself as a customer-centric business focused on transparency and customer education. Trevor Gerszt, its founder and CEO, immigrated to the US and built the firm on a solid work ethic, emphasizing the value of empowering Americans to protect their savings. Over the past two decades, Goldco has built a reputation through significant growth and a focus on high-touch service, which helps attract conservative investors wary of traditional stock markets.

Yet, as with any investment firm, legitimacy hinges on regulatory compliance, customer feedback, and operational practices. It operates under strict IRS guidelines for precious metals IRAs, using approved custodians like Equity Trust Company or GoldStar Trust and depositories such as Brinks Global Services or Delaware Depository.

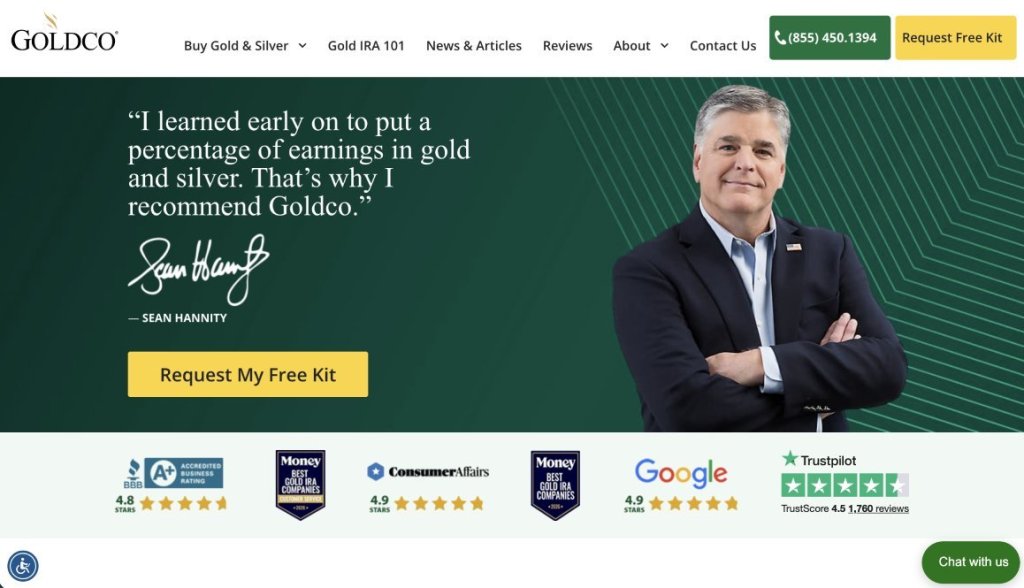

Legitimacy and Industry Standing

Investors often ask whether Goldco is a safe bet in an industry sometimes plagued by scams. From what I've gathered through reviews and public records, it appears legitimate, having maintained an A+ rating with the Better Business Bureau for over a decade. Still, recent critical reviews raise questions about the long-term cost of "premium" products, which I'll explore later. For now, let's break down what the company offers and how it stacks up.

The Track Record

Trevor Gerszt launched Goldco (originally Gerson Financial Group) amid the rising demand for alternative investments. By 2012, the firm had refocused on self-directed IRA rollovers, capitalizing on retirement planning trends. Today, in 2026, it employs a large team of specialists who guide clients through the complexities of precious metals investing and has facilitated over $3 billion in transactions.

The company's growth earned it a recurring spot on the Inc. 5000 list—appearing for the 10th time in 2025—a nod to its rapid expansion in the private sector. Legitimacy is a core concern in this sector, where fly-by-night operations can vanish with clients' funds.

Ratings and Certifications

| Platform | Rating |

|---|---|

| Better Business Bureau (BBB) | Holds an A+ rating, reflecting a commitment to communication and honesty. |

| Business Consumer Alliance (BCA) | Awarded a Triple-A rating, the highest for reliability. |

| Trustpilot | Maintains a 4.8-star rating based on thousands of reviews. |

| Consumer Affairs | Features five-star averages across thousands of reviews. |

These ratings suggest a track record of reliability, though they're not infallible—ratings can fluctuate with new feedback. The firm complies with IRS regulations for self-directed IRAs, ensuring that precious metals are stored in secure, insured facilities. It sources metals from reputable mints like the Royal Canadian Mint or the Perth Mint.

Reviewer's Note: High star ratings are encouraging but don't substitute for due diligence. In my research, I found that while onboarding is highly praised, long-term investors must be aware of how "premium" coin markups affect their total return.

Products, Services, and The Rollover Process

Goldco specializes in gold and silver IRAs, allowing investors to roll over retirement funds into physical assets. The process starts with a free education kit and consultation, where account executives explain options.

Clients can transfer from a wide range of accounts including:

Traditional IRAs and Roth IRAs.

401(k)s, 403(b)s, and 457(b)s.

Thrift Savings Plans (TSPs).

Setup is designed to be efficient, with specialists guiding the step-by-step paperwork and coordinating with the new custodian. Beyond IRAs, Goldco offers direct cash sales for home delivery or private storage. Popular products include:

Gold: American Eagle coins and various bars of 99.5% purity.

Silver: British Britannia coins and 99.9% pure silver bars.

Diversification: While they have historically focused on gold and silver, they also offer platinum and palladium options.

The firm provides extensive educational resources, including free gold IRA kits and market insights, to help novices understand the role of metals in a portfolio.

Storage and Security

Storage is mandated by IRS rules for IRA-held metals. Goldco partners with depositories that offer both commingled and segregated storage options. They often run promotions to waive setup and storage fees for the first few years on larger qualifying purchases, which can provide initial cost relief. For non-IRA purchases, secure delivery to your door is available.

Detailed Fee Structure and Costs

Costs can make or break an investment in precious metals, where margins are tight.

| Fee Type | Amount | Notes |

|---|---|---|

| IRA Minimum | $10,000 to $25,000 | Varies by account; $25k is often the recommended start to lower the fee %. |

| Cash Minimum | $5,000 | For direct non-IRA purchases. |

| Custodian Charge | $80 to $125 | Annual maintenance fee based on account value. |

| Storage Fee | $100 to $150 | Flat annual fee; higher for segregated storage. |

| Setup/Application | $50 | One-time fee for account establishment. |

The company does not charge its own separate commission, but they make a profit on the spread between the wholesale price and the retail price they charge you. Like many in the industry, they do not list individual metal prices online, requiring a phone call for a real-time quote. This can be frustrating for self-service investors but ensures price accuracy in a fast-moving market.

Customer Experience: The Good and The Bad

Feedback from clients paints a mostly positive picture, particularly during the onboarding phase. On Trustpilot, reviewers commend the professionalism and the "seamless" nature of the rollover. Money.com awarded them "Best for Customer Service" in 2026, highlighting their high-touch support.

The Buyback Commitment

One aspect that bolsters Goldco's credibility is their buyback program. If your circumstances change, the company offers to buy back your metals, often advertised at the "highest price". This provides peace of mind for those worried about the future liquidity of their assets.

Addressing Recent Criticism

Despite high ratings, some 2026 reports urge caution.

Critical reviews on Morningstar and BBB highlight a "valuation shock," where account values appear to drop by 40-60% immediately after purchase due to high spreads on premium coins.

One 2025 complaint detailed paying over $92 per ounce for silver coins—far above the spot price at the time.

Critics argue that "free silver" promotions are often funded by these higher premiums, effectively raising the investor's cost basis.

While these experiences are often linked to a misunderstanding of how retail premiums work, they underscore the importance of comparing "melt value" versus retail price before buying.